Browsing Category

Blockchain

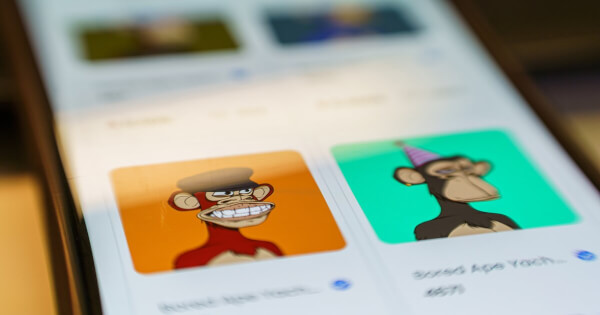

NFT Transactions Projected to Hit $40m by 2027 amid Metaverse Trend

Non-fungible token (NFT) transactions are expected to reach $40 million by 2027 as the metaverse trend continues to gain steam, according to a report by Juniper Research.

The study noted that a 66.6% growth would be recorded during the…

Read More...

Read More...

Public Pension Funds Eroded by Headwinds from Crypto Winter

Pension funds that have bet on the cryptocurrency market over recent years face difficulties navigating the ongoing crash associated with digital assets.

Caisse de dépot et placement du Québec, Canada's second-largest pension fund,…

Read More...

Read More...

Ethereum Address Activity Continues Scaling the Heights

Ethereum (ETH) has been experiencing an uptick in address activity, which has been instrumental in propelling notable momentum.

“The number of ETH addresses holding 32+ coins just reached a 17-month high of 117,257. A previous 17-month…

Read More...

Read More...

Metaverse Giants Collaborate to Form DAO Metaverse Alliance

The blockchain metaverse giants have collaborated to form the DAO Metaverse called "Open Metaverse Alliance for Web3" (OMA3), which aims to bring together multiple virtual worlds to solve the key challenges of the metaverse and maintain…

Read More...

Read More...

Heather Morgan of Bitfinex Crypto Heist Cleared to Seek Proper Employment

American rapper and entrepreneur Heather Morgan, indicted for contriving with her husband Ilya Lichtenstein to launder money, has been permitted by a judge to seek proper employment.

Her case will still be on trial, but she is authorized…

Read More...

Read More...

Celsius Hires New Lawyers for Restructuring: WSJ

Celsius Network LLC has hired new lawyers to advise the troubled cryptocurrency lender on restructuring, according to a report from the Wall Street Journal (WSJ).

The much-needed restructuring plan has come as it seeks to escape the…

Read More...

Read More...

Babel Finance Hires Restructuring Specialist Houlihan Lokey: Sources

Babel Finance, a Hong Kong Bitcoin financial services company offering lending and asset management services, has hired U.S. investment banking firm Houlihan Lokey, a specialist with wide experience in restructuring and acquisitions to …

Read More...

Read More...

Ripple Opens First Office in Canada with New Growth Plan

Ripple, a company behind XRP cryptocurrency, has announced that it is opening a new office in Toronto, which will serve as an engineering hub. The new office, Ripple’s first footprint in Canada, will support the company’s continued growth…

Read More...

Read More...

HK’s PANGU Plays a Magician in Metaverse, Expanding P2E Model for Business Growth

Hong Kong-based start-up PANGU, a metaverse agency appointed by Sandbox, is helping clients to enter into the metaverse by providing asset creation and branding consultation services. The company said it is building various business…

Read More...

Read More...

Bitcoin Investment in Pension Portfolio Diversifies Inflation Risk: First Digital Trust CEO

Blockchain.News recently had a conversation with Mr. Vincent Chok, the CEO of Hong Kong-based First Digital Trust, a technology-driven financial institution powering the digital asset industry, to help explore whether the cryptocurrency…

Read More...

Read More...