The past, present, and future of liquidity mining

In the present global market scenario (21st century), liquidity is becoming one of the crucial factor/s quotidians. Before 2008, liquidity majorly focused on stocks, bonds, property, etc, but since 2008 (Bitcoin’s Whitepaper entering the market) it is shifting towards digital-decentralized liquidity via blockchain and similar platforms. Needless to point out that the factors affecting the conversion from assets to cash and vice-versa has become quicker, safer, and complex for third parties who desire to hack. Another benefit in the liquidity process has been that the time restrain has somewhat been lifted. The reason for saying so is that as blockchain is an open-source platform, miners across the world mine blocks according to distinct time zones allowing the whole liquidity ecosystem to function almost 24*7 (24 hours a day, 7 days a week). This piece goes through some angle of liquidity mining’s past, present and the potential future.

Liquidity mining before 2008, meaning before digitalization and globalization got intermixed, few authoritative financial institutions administered the overall liquidity process. But after the 2008 financial breakdown, the trust factor in authorities started declining which is one reason decentralized platforms like blockchain and applications like decentralized finance entered into the picture. One of the major factors for liquidity mining to see such sustainability to date is that it functions on two fundamental technologies. They are public-private key cryptography for storing and spending financial currency, and the cryptographic validation of transactions.

In short, liquidity mining is a network mechanism where users/nodes in the network offer their capital to the respective protocol, while in return they receive the protocol’s native token. The present scenario of liquidity mining is such that it’s being utilized in consumer payments. The gradual interest and usage of mining via decentralized applications arose as credit and debit card system’s overall functionality and pricing received quite a lot of criticism (majorly, fee charge being too high). One way of looking at the scenario is that as credit/debit cards had a monopoly for some time, they started changing the supply-demand as per their wishes. Avoiding to thoroughly observe what consumers wanted and desired, the trust factor started to get diverted towards decentralized platforms.

It’s expected that in future, liquidity mining might be utilized for general-purpose payments, perceived as a mainstream store of value as well. Few computer scientists are suggesting that Bitcoin is seen as more favorable more because of its ability to develop a decentralized record of almost anything rather than its ability in facilitating payments. The opportunities for liquidity mining in coming days is huge provided various application providers can instill confidence in customer’s/potential customer’s value and adoption.

According to this piece of research (Table 3), a comparison has been conducted to figure out the pros and cons between usage of ‘Gold’, ‘Traditional Credit Money’, and ‘Cryptocurrencies’. Out of 10 different categories, only three categories come under the category of ‘not preferable’. The two areas where improvement needs to take place while doing liquidity mining include “security and internal value”, “commissions and financial costs”, and “integration level of the instrument”. In a nutshell, this piece of research indicates that as traditional monetary practices have been in use for a long interval, the shift to decentralized platforms and applications may take a while. If people are made to understand (using distinct context) numerous benefits of employing it in short-term as well as in the long-term, they would without any friction start using decentralized applications.

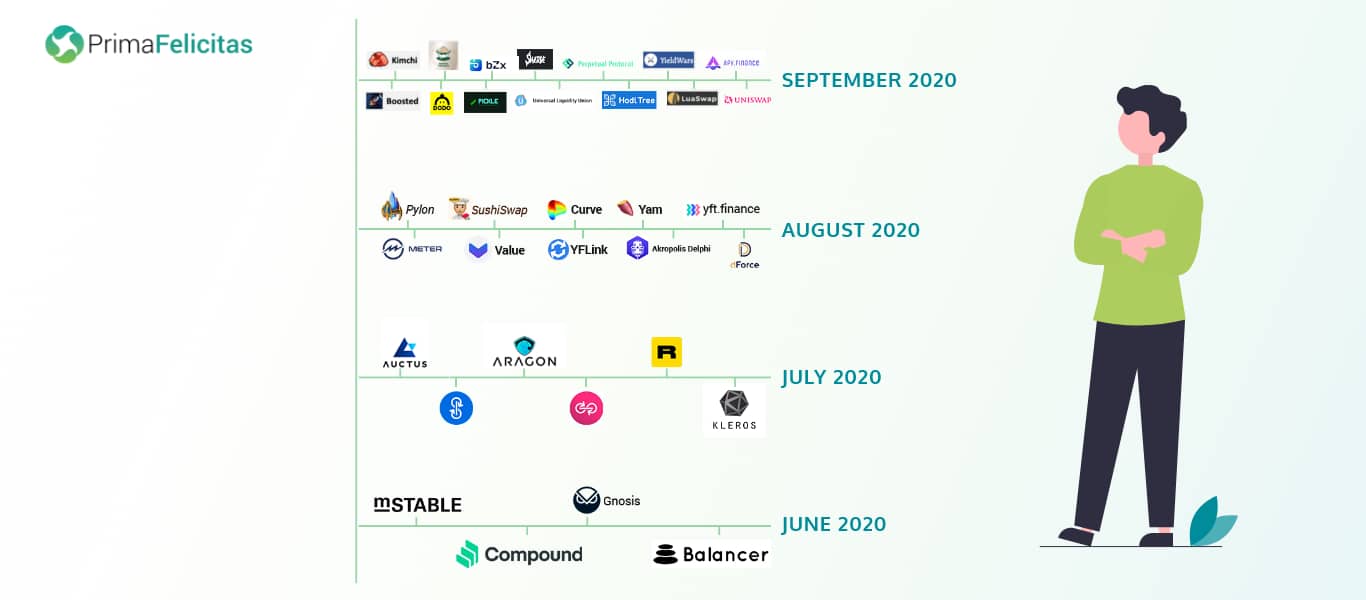

As one may observe from the above infographic, the number of applications for liquidity mining has been increasing in usage quite rapidly. One practical illustration of liquidity mining getting employed in almost every industry is this piece of the survey. The survey majorly focuses on blockchain networks from the angle of consensus protocols developed in an open-access P2P grid. A transaction can be said as the atomic data structure (subtle building blocks) of a blockchain. For protecting the authenticity of a transaction, functionalities like hash function, asymmetric encryption, etc are employed. Besides the factors mentioned above,

- Validity/Correctness/Honesty

- Agreement/Consistency

- Liveness/Termination, and

- Total Order

are used for further making the consensus among each node in the grid strong, robust, and transparent as well. Just like any technology/concept needs an update in a particular time interval, similarly, mining concepts/protocols designed and built be Nakamoto requires some degree of upgradation. The modification (in-process) namely is referred to as “virtual block mining and hybrid consensus mechanisms”. Table 5 showcases different consensus protocols where liquidity mining can be achieved smoothly. Figure 19 explains the difference in performance between centralized databases, hybrid consensus protocols, scale-out protocols, and basic Nakamoto protocols. So, based on the usage of a protocol, its complexity, total time duration, etc factors, appropriate protocols could be opted for liquidity mining to take place effectively and productively.

Looking for help here?

Connect with Our Expert for

a detailed discussion

Post Views:

17